Terms of Service

Terms of Service and Conditions for LendMe

1. INTRODUCTION

These Terms and Conditions apply to and regulate the provision of Credit facility , Bills payment and Smart investment service offered by BE RESOURCES LTD trading as LendMe (hereinafter called "The Lender" or "LendMe") to the ‘’Borrower’’ or ‘’Customer’’ herein. These Terms and Conditions constitute the Service provider's offer and sets out the terms governing this Agreement. Kindly ensure to carefully read and understand the terms and conditions stated herein before opting in for any of the services offered

2. COMPANY DETAILS

BE RESOURCES LIMITED was incorporated in Nigeria with the Corporate Affairs Commission under the Companies and Allied Matters Act, with registered office addresses in Lagos, Nigeria. BE RESOURCES LIMITED is an authorized financial services provider in Lagos, Nigeria. By using the LendMe platform, you confirm that you are resident in Lagos State and are entitled to get credit facilities from BE RESOURCES LIMITED on the basis of your residence and residential address provided by you.

3. DEFINITION

In these terms and conditions, the following words and expressions (save where the context requires otherwise) bear the following meanings: "You", "Your", "Customer",

and "Borrower" mean the person who applied for this service and agrees to this Agreement while "We", "Us", "Our", "LendMe" and "Lender" shall mean BE RESOURCES LIMITED trading as "LendMe", and following an assignment, any person, company or bank to whom the rights and/or obligations of the Lender have been assigned. "Profile" means the customer's account with the Lender. ‘’Profile Owner ‘’ means the person in whose name a LendMe profile was created "Disbursement Date" means the date the Lender actually advanced the loan to the Borrower. "Payment Due Date" means a period between sixty two (62) and three hundred and sixty five (365) days, except otherwise stated after the loan has been given except where extended. "Micro Loan" means the Loan which has been issued by Be Resources Trading as LendMe and the amount of which is not higher than N100, 000 .00 (One Hundred Thousand Naira maximum) and which has a repayment period not exceeding three hundred and sixty five (365) days. "Loan" means the amount advanced to the Borrower by the Lender, which shall be no less than N1,000 (One Thousand Naira only). “LendMe smart Invest” means the service of Be Resources Ltd provided within the LendMe App that enables the customer to instruct the App/service Providers to place funds in investment based on understanding and acceptance of the service offerings terms and conditions.

“BVN” means the bank verification number identifying the person in whose name a LendMe smart invest service is existing or as may be otherwise prescribed by the law.

“Customer support helpdesk” means the customer support offered by Be Resources Limited via the LendMe App or

through direct interaction with their customer support personnel through the email address help@myLendMe.co “Device” includes your mobile phone handset, SIM Card, which when used enables you to access the

service “Investment” means funds placement in return for a promised return at the Prevailing market rate. “IS”is the investment statement is an electronic document which shows the investment yield at the maturity date “Investment Period” means the date from which you accept these LendMe smart invest Terms and Conditions “Interest Rate” means the rate of interest payable on the Investment as shall be notified to you through the App , which rate may be varied by the service Providers according to market dictates “Transaction Fees” means the charges payable by customers for use of the service “Bills payment “ prepaid service available on the LendMe App at the lowest cost possible for airtime, PHCN etc ‘’ Smart integration ‘’ platform we use to link and access a secure exchange of real-time financial information for our customers from their banks to us by linking their internet banking or bank account to the App. ‘’Opt in’’ this is when a customer subscribes to having certain amount deducted from their wallet for investment purposes ‘’Cash out’’ this is when the customer wishes to withdraw from the investment either fully or partially before investment matures .

4. AUTHORISATIONS

To provide this service to you, LendMe works with organisations (such as payment companies) and other service providers (“Partners”). We may be required to obtain, verify or provide information about you or your transactions carried out using the Wallet to any of these parties. You hereby authorise us to obtain, verify, and share such information to the extent required for the performance of their duties, with these Partners. This authorization shall also extend to the Partners.

5. JURISDICTION AND RESTRICTION

The materials and information contained in this section of this mobile app is directed at and restricted to individual’s resident in or entities having a place of business in Lagos, Nigeria ONLY. The Lender makes no representation that the materials and information contained herein is appropriate or available for use in other locations / jurisdictions either directly or through adverts or solicitations. These Terms and Conditions are governed by and construed in accordance with the laws of Nigeria.

6. CONSENT

By using the LendMe platform, you consent and agree as follows:a. You agree to access and use our mobile app for lawful purposes. You are solely responsible for knowledge of and strict adherence to any laws, statutes, rules and regulations now in force or later enacted at a future date.

b. You understand fully that we are largely electronically distributed and we can provide materials and other information about your legal rights and duties to you electronically which you will be responsible for updating yourself with.

c. You are responsible for providing all hardware, software, telephone or other communication equipment and/or service to connect to the internet and access our mobile app and are responsible for all Internet access charges, mobile charges or other fees or charges incurred in connecting to the Internet to our mobile app.

d. We are authorized to share, receive and use data/information collected from your transaction with other affiliated Third parties.

e. Your electronic signature on agreements and documents has the same effect as if you signed them using ink on paper or any other physical means.

f. We can send all important communications, billing statements and demand notes and reminders (collectively referred to as "Disclosures") to you electronically via our mobile app notifications or to an email address that you provide to us for while applying for this loan.

g. You are agreeing and confirming that you do not reside in, or are not proposing to subscribe for our services from, any jurisdiction outside Lagos, Nigeria.

h. You are solely responsible for any charges or damages that may be incurred as a result of your neglect to maintain the strict confidentiality of your mobile identity which may include username, password and others

i. You are expressing and confirming your irrevocable approval for direct debit by us from all bank accounts which you have.

j. You are agreeing and confirming that you read our Privacy policy published on our mobile app.

k. You are declaring and confirming that your age is 18 years or above and your registered address is in Lagos.

7i. LENDER’S OBLIGATIONS

a. To make available the loan/credit facility to the Borrower of a figure not less than N1,000.00 (One Thousand Naira only). b. To perform (a) above upon confirmation of the Borrower’s identity and personal information.

c. To demand repayment for the Borrower as and at when due.

d. To verify the Borrower ’s details prior to opening a service for the Borrower.

e. To use all reasonable and legitimate means to collect the amount extended to the Borrower, the overdue fee, the processing fee, the tax and any other penalty fee imposed on the Borrower as a result of the loan.

f. Not to store or save Borrower’s debit or credit card details given by the Borrower in the application form.

7ii. BORROWER’S OBLIGATIONS

a. Pay to us, on or before the due date, the loan sum, including any convenience, processing fee, tax, overdue or penalty fees, and other amounts due to the Lender charged to this Account.b. The Borrower will be deemed responsible for any unauthorized application using this service unless the Borrower notifies the Lender, in writing, of imminent fraud by another person on the Borrower’s service within 12 hours of such fraud.

c. To repay the loan given to you and/or to someone you authorized to use this service via direct cash transfer to a bank service listed by the Lender, an electronic debit from the card/service you provided on the due date, or through an acceptable electronic channel. The Lender reserves the right to accept early repayment before the Payment Due Date, provided the Borrower has given adequate notice and repays full loan along with the processing fee and tax. Loan repayment via electronic debit card may be affected by the Lender in the way and manner hereinafter specified.

d. The Lender shall charge a one - time processing fee the first time a Customer sets up a new debit card on the Account. The fees are non refundable. In addition, the Lender will charge a fee for BVN verification to confirm the ownership of the account. There is a semi annual card maintenance fee chargeable on the service during the course of business. This is charged per card. In the event the card is expired or about to expire, you will have to obtain a renewed card from your bank or provide us with another personal debit card.

e. The Lender shall deduct from the card setup on the repayment due date. We will never make any transactions on the card outside of the scheduled loan repayments. In the event of a double repayment initiated in error by you, we will on a best effort basis process a refund within a reasonable time.

f. You hereby indemnify us against any and all losses, liabilities or damages that may arise in the event that you use a third party's card on your service without the consent of such third party.

g. In the event of a default or insufficiency of funds in your bank account, you hereby authorize us to charge any other cards you may have on your service or profile other than the primary card listed on an ongoing basis until the debt is settled. You agree to keep your card validity up to date at all times or once you are aware of the likely expiration date.

h. Based on your NUBAN and without further recourse to you, you hereby authorise us to use the right to set off on your indebtedness on any of the bank accounts that you may hold regardless of the one that is directly linked to the outstanding sums.

i. You understand and agree that we do not store card details on our platform thus card details shall be processed through a secure payment gateway that is PCI DSS compliant.

j. To give The Lender authentic and up - to - date personal, social media, phone and financial records about you that we may reasonably request and analyze, from time to time.

k . To pay all costs of collection if we take any action to collect this service or take any action in a bankruptcy proceeding filed by or against you. This shall include, unless prohibited by applicable law, reasonable attorneys' fees and expenses incurred while collection lasts.

l . Not to give us false information or signatures, electronic or otherwise, at any time.

m . To pay any overdue fee or penalty fee as may be provided in these terms and conditions.

n . To make all payments via direct debit on cards or by electronic funds transfer as stated in the application form.

o . To promptly notify us if you change your name, your mailing address, your e-mail address or your telephone number.

p . To honor any other promises that you make in this Agreement.

q. That you will not accept this service unless you are of legal age and have the capacity to enter into a valid contract.

r . Not to use our mobile app for any act of illegality or criminality as we will not be criminally culpable for any illegality committed by you.

s . To fill out the application form (as provided) with accurate information and details as required.

t. You must comply with our Acceptance Use Policy at all times when using the Service.

u. You may never use another user’s service without permission.

v. You may not disassemble, decompile or reverse engineer the Service or attempt or assist anyone else to do so.

8. CHARGES/FEES

a. The Lender may charge processing fee and tax, overdue fee, penalty fee and in the event of any dispute arising from these Terms and Conditions, the cost of Litigation/Solicitors’ fees.b. The Lender will charge an interest rate not exceeding 1.05% per day of the loan amount but subject to instant adjustment based on market conditions. The transaction fee may be increased or decreased from time to time by the lender. Such change in transaction fee will take immediate effect and shall become payable from the Borrowers service having received written notice for a period not less than fifteen days prior to the date change in Transaction Fee to occur.

c. The facility shall have a processing fee not exceeding 1% of the loaned amount. Processing fee may either increase or decrease from time to time, and adequate written notice will be sent to the Borrower on any change, thereof.

d. Overdue fee is associated with late repayment, and it is 1% of the overdue capital, calculated on a daily basis.

e. The transaction loan does not preclude the Lender from charging default fee, penalty fee and in the event of any dispute arising from these Terms and Condition -the cost of Litigation/Solicitors, arbitration or any other form of legal settlement. Total transaction Fee of the loan will still be due in the event of the Borrower liquidating the loan before expiration.

9. REPAYMENT

a. Borrower is expected to repay back the loan sum with accrued interest on or before the due date.b. Borrowers must repay through the repayment channels provided by us. The channels include: our partner’s platform.

10. EVENT OF DEFAULT

In the event the Borrower continually fails to make any scheduled repayment in full on or before the payment due date,or after exploring the loan restructuring options available or in the event of any information or documentation given by the Borrower in connection with the application for this loan is later discovered to be materially incorrect. Kindly contact customer support helpdesk for more information on the restructuring options .

a. The Lender reserves the right to institute legal proceedings against the defaulting Borrower, and may issue demand letters to the Borrower, either electronically or to Borrower’s physical address, before commencing proceedings.

b. The lender reserves the right without recourse to add the name of the defaulting customer to the periodic returns made to the credit bureau which will impair the future chances of further credit extension of other financial institutions.

c. The Lender also reserves the right to assign its right, title and interest under the agreement to an external Collections Agency who will take all reasonable steps to collect the outstanding loan amount and fees.

11. CREDIT REFERENCE

The Lender or its duly authorized staff/representatives/agents will utilize Credit agencies for a credit report on the borrower in considering any application for credit. The Borrower authorizes the Lender to access any information available to the lender as provided by the Credit Agency. The Borrower also agrees that the Borrower’s details (save the card details) and the loan application decision may be registered with the Credit agency.

12. SET-OFF

The Lender may at any time with or without notice

(a) combine or consolidate some or all of the Borrower’s service with any liability to the Lender and

(b) set off and transfer any sum standing to the credit of such service in full or partial payment of any amount the Borrower owes to the Lender. This clause is in addition and does not amend or qualify other present or future right of the lender to combine or set off Borrowers service with it. After five (5) working days of the Lender the right: to pay loan from the scale of Borrower’s inventory without notice, to activate the Direct Debit Mandate to recover proceeds from the Borrower’s corporate and personal account.

13. NOTICES

The Borrower agrees that the Lender may communicate with them by sending notices, messages, marketing or business-related information, including information about Service updated or changes, via email or via our blog, which is located at the URL, alerts and statements in relation to this Agreement, either electronically or to Borrower's physical address.

You agree to allow us to use your personal data, or any other means or manner we deem appropriate or necessary to determine whom to notify. We warrant and represent that we will only make such notification if you default on your financial obligation to us.

14. RIGHT TO COLLECT ON DEBT

By using the service, you agree to grant us an irrevocable written authorization to issue open-ended direct debit mandates for all accounts you own now, or at any point in future. If you default, you agree that LendMe has your written authorization to place a lien on every service you own, or at any point in the future, to recover any outstanding balance you owe us at the execution of the direct debit mandate, singularly or severally from one or more of your accounts, without any notice or further obligation to you, and may continue to execute direct debit mandate on your accounts until such time as your financial obligation to us have been fulfilled. We also reserve the right to contact your social circle via sms messages, whatsapp, phone calls and the use of other social media about your outstanding debt and obligations. We warrant and represent that we will only execute a direct debit mandate if you default on your financial obligation to us

15. LendMe SMART INVEST

Terms and Conditions for LendMe smart invest

You shall be deemed to have read, understood, and accepted these terms and conditions. The following applies when a customer opts in for LendMe smart invest ;

Upon clicking on the “Accept” option on the App , LendMe assumes that you have read, understood and agreed to abide with these investment terms and conditions.

By applying to access the LendMe smart Invest, you agree to comply with and be bound by the terms and conditions governing the operation of the Investment as a service and you affirm that the terms and conditions are without prejudice to any right that the service providers may have with respect to the LendMe smart Invest service in law or otherwise.

You irrevocably agree that all transaction fees and all other charges in connection to your use of LendMe Smart invest will be borne by you the customer and authorize the providers ‘’Be Resources’’ authorization to debit as appropriate.

As a subscriber of the LendMe smart Invest , you will be subject to the terms and conditions of the LendMe App

As a subscriber of the LendMe smart Invest, you can subscribe for an investment by using the roundup feature in the App.

You may opt in or out from your LendMe smart Invest subject to the terms and conditions that guides the use of the service

You will be entitled to interest income in respect of your Investment at the Prevailing Rate. Interest accrued will be credited to your wallet at the expiration of the tenure communicated to you in the App.

LendMe reserves the right to make adjustments to the interest rate in accordance to the prevailing market conditions

Termination of Investment

All investments have tenures all of which are expressly stated before the commencement of an investment cycle. You will be advised at the end of each investment tenure through the App and via your email address.However, if for any unforeseen emergency reason you wish to terminate your investment before the expiration date you can do so on the app . There is a penalty attached to opting out before maturity, this will be automatically calculated and applied without recourse to the customer.

You have a responsibility to check that everything is in order on your statement and quickly notify the service providers through the customer support helpdesk of any anomaly or anything you need clarifications on about LendMe smart invest

Irrevocable authority to ‘’BE RESOURCES LTD’’ owners of ‘’ LendMe smart invest ’’

It is the customers responsibility to get accustomed to the operating procedures for the service as will be provided by Be Resources Ltd upon your subscription to LendMe smart invest service. The service providers will not be liable for any losses incurred as a result of your errors.

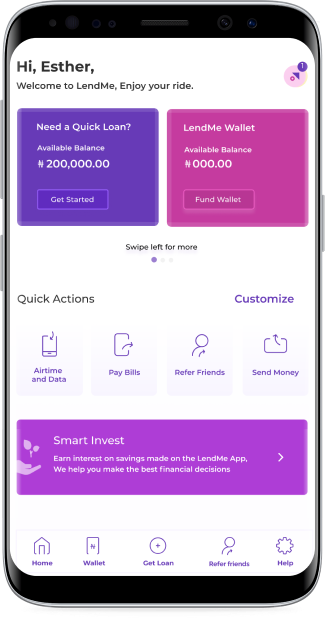

16. LendMe WALLET AND BILLS PAYMENT

By agreeing to use the LendMe app to access a loan , all loan disbursement will be made directly into the wallet . Customers can then use funds from the wallet as they desire. We offer bills payment services on the LendMe App such as recharging airtime for any nigerian network, paying your internet subscription,Cable TV, PHCN bills etc. The list of accredited billers will be made available on the App and updated as new ones are added. Funding and transfer from wallet All loan disbursements will only be made

into the wallet .The wallet can also be funded using a Bank card/ Customers Bank account /USSD and you can transfer the same back into your own wallet Or a 3rd party LendMe wallet. We may not process your transfer or bills payment for the following reasons: you have insufficient funds in your wallet. there is a suspicion of fraudulent or illegal activity on your LendMe Account. there is a suspicion of unauthorised access on your LendMe Account. we (‘’LendMe and/or our Partners’’) are legally restricted from completing the trainers . Please note that you are responsible for providing the correct details for the

recipient of your transfers or payments. Where payments are made according to your instructions and those instructions were wrong, but authorised, we will work with our partners to assist you in retrieving the amount if you notify us promptly. Where we are unable to retrieve the payment, we will assist you with the relevant information in our possession that you may need to reclaim your funds. Keep your wallet safe It is your duty to keep all security information relating to your wallet and the LendMe App secure. Where you suspect that the security of your Wallet may have

been compromised, you are required to change your LendMe App password. LendMe will not be liable for transactions carried out where access to your Wallet has been compromised by you or any fraudulent manipulation outside of our control. Transaction disputes can occur when your service is debited twice for the same payment or when you have made payment by transfer and the App debits for the same repayment and/or when you have transferred from your bank or any account to us but we do not have funds in our position . Kindly note that upon notifying us our standard business practice for transaction disputes 3 to 5 working days to enable our

fulfilment partners work on reversal .Kindly notify us immediately you become aware of an unauthorised transaction on your Wallet by contacting our customer support team on help@myLendMe.co. Failure to do so may discharge us of any legal obligation to assist you.

17. INTELLECTUAL PROPERTY RIGHTS

All contents of the mobile app including but not limited to the texts, graphics, links and sounds are the copyright of BE RESOURCES LIMITED trading as LendMe and may not be copied, downloaded, distributed or published in any way without the prior written consent, in part or whole, of BE RESOURCES LIMITED

You also hereby agree that the Lender can share your information to third parties for any purpose it deems including, without limitation, the copying, distribution and publication thereof, unless restricted by applicable laws.

18. USE OF MATERIALS AND INFORMATION

The information and materials contained in these pages, and the terms, conditions, and descriptions that appear, are subject to change.

Unauthorized use of BE RESOURCES LIMITED trading as LendMe and systems including but not limited to unauthorized entry into BE RESOURCES LIMITED trading as LendMe, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. All services are available ONLY in Lagos.

Materials, information, marks and logos contained in or displayed on this Website are protected by intellectual property rights under applicable laws. No part of these material, information, marks and logos may be modified, reproduced, stored in a retrieval system, transmitted, copied, distributed or used in any other way for any commercial or public purposes without the written permission of BE RESOURCES LIMITED trading as LendMe

19. ENTIRE AGREEMENT; SEVERABILITY; WAIVER

These Terms constitute the entire agreement between you and LendMe concerning the Service replacing any prior or contemporaneous agreements, terms or conditions applicable to your use of the service. If a provision of these Terms is found to be unenforceable, the remaining provisions of these will remain in full force and effect and an enforceable term will remain in full force and effect and an enforceable term will be substituted reflecting as closely as possible our regional intent. LendMe’s failure to enforce any provision of these Terms shall not be deemed a waiver of its right to do so later.

20. ASSIGNMENT

These Terms and any right and licenses granted hereunder, may not be transferred or assigned by you, but may be assigned by us without restriction. Any attempted transfer or assignment by you will be null and void.

21. PRIVACY

Unless restricted by applicable laws, you agree that any and all personal data relating to you collected by the use from this Website may from time to time be used and disclosed for such purposes and to such persons as may be in accordance with our Privacy Policy as amended from time to time. A copy of our Privacy Policy may be obtained by clicking here

22. LINKS AND URLS

The app may contain links to websites controlled by third parties or non-affiliates (Non- Affiliates of BE RESOURCES LIMITED trading as LendMe). LendMe hereby disclaims liability for any information, materials, products or services posted or offered at any of the third-party sites linked to the app.

23. DISCLAIMER

While every care has been taken in the preparation of materials in this mobile application, such materials and information are provided on an "as is" or "as available" basis. LendMe does not warrant the accuracy, adequacy or completeness of this information and materials and expressly disclaims liability for errors and omissions contained. No representation or warranty of any kind, express, implied or statutory regarding non- infringement, security, accuracy, reliability, fitness for purpose or freedom from computer viruses is given in connection with such materials and information

24. LIMITATION OF LIABILITY

Under no circumstances shall BE RESOURCES LIMITED, its subsidiary and parent companies or affiliates of their respective Directors, officers and employees, agents contractors, licensors or assignees be liable for any damages including without limitation, direct or indirect, special, incidental or consequential damages, loses or expenses arising from this agreement or in connection with this site or its use thereof or any linked site or app for use thereof or inability to use by any party or in connection with any failure of performance, error, omission, interruption, defect, delay in transmission, computer virus or operating failures even if BE RESOURCES LIMITED or our representatives are advised of the possibility of such damages, losses or expenses.

25. INDEMNITY AND WARRANTIES

Your hereby agree to indemnify and to keep BE RESOURCES LIMITED, its affiliates, parents and subsidiary or parent companies, their directors, employees and agents fully and effectively indemnified against any action, liability, cost, claims, loss, damage, proceeding or expense (legal or otherwise) arising from any breach of this agreement or any other policy used or accessed from this app related to content transmission.

The service is provided as an "as is'' and "as available" basis without any warranty of any kind, whether express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose, or non-infringement. LendMe is not responsible for any third-party content that you download or otherwise obtain through the use of the service or for any damage or loss or data that may result. We do not warrant, endorse, guarantee, or assume responsibility for any third-party application or service that provides access to our service. The service is controlled, operated and hosted from within. We make no representations that the service is appropriate or available for use in other locations. Those who access or use the service from other jurisdictions do so at their own risk and are responsible for compliance with all applicable Nigerian Laws and regulations including but not limited to export and import regulations.

26. MODIFICATION OF THE SERVICE

The Service may be modified from time to time, often without prior notice to you. Your continued use of service constitutes your acceptance of such modifications. If you are not satisfied with a modification we make to the Service, your sole remedy is to terminate your use of the Service.

27. YOUR USE OF LendMe SOFTWARE AND DATA TRANSFER

As part of the Service, we provide downloadable client software (the "Software") for your use in connection with the Service. This Software may update automatically and if such software is designed for use on a specific mobile or desktop operating system, then a compatible system is required for use. So long as you comply with these Terms, we grant you a limited, nonexclusive, non-transferable, revocable license to use the Software, solely to access the Service; provided, however, that this license does not constitute a sale of the Software or any copy thereof, and as between LendMe and You, LendMe retains all right, title and interest in the Software. LendMe may transfer, analyse, modify or store and process your Content in Nigeria or in any other country in which its agent maintain facilities. By using this service, you consent to this transfer processing and storage of your Content.

28. TERMINATION OF THE ACCOUNT

a. We may terminate this Agreement at any time and for any reason subject to the requirements of applicable law without any notice.b. We may also terminate your service in case of default in paying the loan sum and fees or for non-compliance with the terms and conditions stated therein within the agreements. This will include the usage of the service in a manner that may cause financial or legal liability.

c. We can terminate your service by sending a written notice, either electronically to your email address, phone number or to the physical address on your application.

d. If there is no transaction on your service for twelve (12) consecutive months, we may terminate this service without notice to you.

e. When termination arises as a result of credit default you will not be able to apply for credit in the future.

29. COPYRIGHT AND INTELLECTUAL PROPERTY RIGHT

LendMe respects the intellectual property rights of others and we expect our users to do the same. We respond to notices of alleged copyright infringement if they comply with the law, and such notices should be reported to our Copyright Agent.

This service (excluding Content provided by the user) constitutes LendMe intellectual property and will remain the exclusive property of LendMe and its licensors. Any feedback, comments or suggestions as we see fit and without any obligation to you.

30. GOVERNING LAW

The Use of this website shall be governed by all applicable Laws of the Federal Republic of Nigeria. BE RESOURCES LIMITED corporate offices are located in Lagos State ONLY.

Thus, the Borrower hereby consents that in a case of any dispute whatsoever in connection with this Agreement, shall be governed by and construed in accordance with the laws of the Federal Republic of Nigeria.

31. CONTACTING LendMe

Any query and complaint you may have relating to our services shall be addressed to through the App and via the helpdesk email: help@myLendMe.co